Data Retrieval Tool Status Information

The IRS Data Retrieval Tool (DRT) allows students who have already filed their federal income tax returns to prefill the answers to some questions on the Free Application for Federal Student Aid (FAFSA) by transferring data from their federal income tax returns. This can save the family some time in completing the FAFSA.

If the student or parent is eligible to use the IRS DRT, it is highly recommended that they use the tool for the following reasons:

-

It is the easiest way to provide tax data.

-

It is the best way of ensuring that the student FAFSA has accurate tax information.

-

The student or parent does not need to provide a copy of their tax return to your institution.

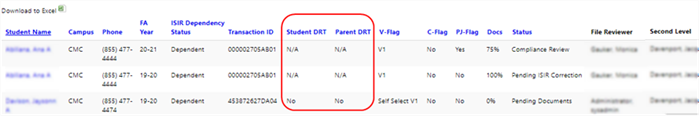

From any list view from the Dashboard or Worklist, the Student DRT and Parent DRT columns display this information for the student record.

-

Yes - The student/parent used the DRT when completing the FAFSA

-

No - The student/parent did not use the DRT when completing the FAFSA

-

N/A - The student/parent did not file, is not eligible to use the DRT, or a parent is not on the ISIR