Correct ISIRs

The ISIR corrections process is similar to the ISIR verification process in that both processes modify ISIR data. Verification is done at the request of the FAFSA Processing System (FPS) when a student is assigned to a verification group. Corrections are made for reasons such as:

-

The ISIR returned by FPS contains Comment codes, C codes, and/or Reject codes that need to be resolved by the institution.

When you open an ISIR record, the Comment codes, C codes, and/or Reject codes will be displayed in a collapsible section at the bottom of the form. Select the ellipsis (...) button to view the code descriptions provided by the Department of Education. Follow the instructions given in the code descriptions. Some codes may require corrections in the ISIR, others may require the student to submit additional documentation. Once you have completed the required actions for the codes, save and export the ISIR to send the changed values back to the FPS.

-

The institution obtained documentation from a student and some of the documentation conflicts with the information on the FAFSA/ISIR.

After completing the correction process, the ISIR is sent back to FPS. Subsequently, a corrected ISIR is imported into Anthology Student.

The objective of the ISIR corrections process is to ensure that the student’s ISIR is accurate and that the EFC/SAI is calculated correctly by Anthology Student. The EFC/SAI is required for the financial aid packing process and impacts a student's financial aid awards.

A configuration option in Anthology Student determines whether an EFC/SAI value that is recalculated due to ISIR corrections is displayed on the Awards form and applied to the packaging process.

Tip: When you correct or verify ISIRs for the 2024-25 award year or later, tax information is hidden.

Tax data for a contributor can be made available in the manually reported section of an ISIR or, when provided by the IRS, in the Federal Tax Information (FTI) section of an ISIR. Corrections are not allowed in any of the FTI fields. A student or a Financial Aid Administrator can only make/submit corrections to manually reported data fields. As a result, only manually reported data fields are shown as part of the Corrections form.

You can access data reported in the FTI section by either selecting the Verification button, printing the ISIR, or accessing the SAI Calculator.

Prerequisites

You must have:

-

Common - Student - View authorization

-

Financial Aid - ISIR - View and Edit authorization

Access Method

Select the Students tile > select the name in the Students list > expand Financial Aid > select the ISIRs Received tile > select an Award Year > select an ISIR ID > select Corrections.

Procedure to Correct ISIRs

-

Select a Student and navigate to the ISIRs Received tile.

-

Select an Award Year from the drop-down list. The ISIRs received for the selected award year are displayed in the grid.

-

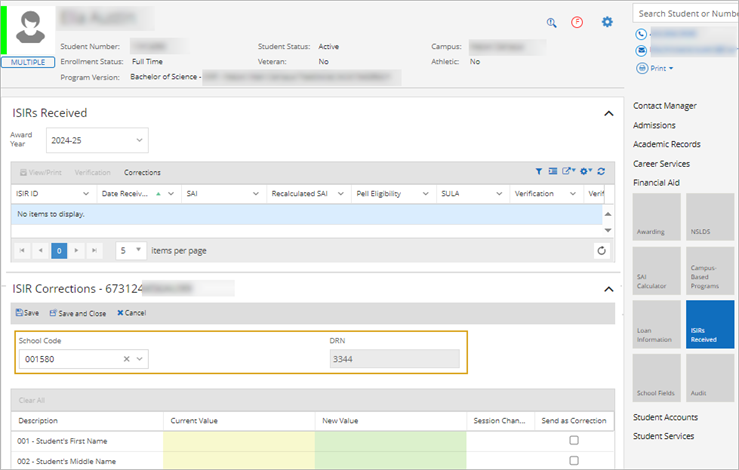

Select an ISIR record and select Corrections in the grid toolbar. The ISIR Corrections grid is displayed in the bottom section of the form. The ISIR ID of the selected record is appended to the title of the ISIR Corrections form.

If no ISIR is on file and you want to proceed with the corrections process, refer to Procedure to Correct ISIRs Using the DRN.

-

Select the School ID in the header of the ISIR Corrections form.

ISIR Corrections grid columns:

The items in the grid are sorted by the Student Aid Report (SAR) field number.

-

The first time the ISIR Corrections form is opened, the Current Value and New Value columns show the same data (i.e., data provided by the student on the FAFSA), and the Send as Correction check boxes are cleared. The Current Value column is not editable. The New Value column is editable.

The New Value column is not editable for fields that contain Personal Identifiable Information (PII), such as student spouse, and parent name, suffix, date of birth, and SSN. No data entry is allowed in the PII fields.

Enter the correction data in the New Value column. Select

to view a dialog that displays valid content for the field.

to view a dialog that displays valid content for the field. The yearly close-out date of September 17 applies to changes in values to the parent's income. For example, if you change the parent's income on an ISIR for the 2019-20 award year after 9/17/2020, the new income value will not be used in the EFC/SAI recalculation and the recalculated EFC/SAI will not be propagated to the Awards form.

-

After you have made a correction, an icon appears in the Session Change column, and the Send as Correction check box is selected.

To undo a change, clear the Send as Correction check box.

-

Manually select the Send as Correction check box to confirm a value based on a comment code.

For example, if a name mismatch is flagged and you verify that the name on the ISIR matches the name on the student's SSN card, select the Send as Correction check box to indicate that the name was verified and is correct.

ISIR has pending correction

-

Select Save to save your corrections.

Alert Message to Set the PJ Flag

For the 2024-25 and 2025-26 award years, the Financial Aid Officer (FAO) will need to set the Professional Judgment Flag (PJ Flag) when overriding the Federal Tax Information (FTI) and recalculating the Student Aid Index (SAI) on an ISIR. The PJ Flag is no longer applied just for PJ adjustments; it is for corrections and updates as well.

When you save a change to a field, the following alert message will appear in Anthology Student:

"If corrections are made to manually reported fields that use Federal Tax Information (FTI), the user should set the Professional Judgment (PJ) Flag to 1 = Yes for manual corrections to be used in the SAI calculation."

This alert message does not prevent you from submitting the correction before setting the PJ Flag (Override).

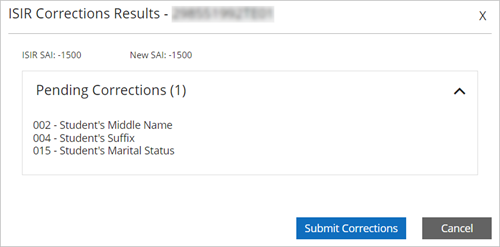

A pop-up displays the current and new (recalculated) EFC/SAI, the corrected fields, and you can decide whether you want to submit the corrections or cancel to return to the previous state.

When ISIR corrections are exported, the changed values are sent back to the FPS.

When income values on an ISIR are changed through the verification process (refer to Verify ISIRs), the Awards form will display the recalculated EFC/SAI and the status “ISIR Corrections Pending".

-

If assumptions/rejections were made by the FPS when the student’s FAFSA was evaluated, the assumptions/rejections will be listed on the Overrides tab of the ISIR Corrections form. The verbiage for assumptions and reject codes matches the Technical References published by the Department of Education.

Select the Overrides option and review the assumptions/rejections. Clear the override check box as appropriate for each assumption/rejection. This will indicate to the FPS that the assumption/rejection should be suppressed, and the next time a subsequent transaction is received after you send the corrections, the assumption/rejection will no longer appear.

-

To undo your changes made in the current session, select Clear All.

-

To save your overrides, select Override.

-

To close the form without saving any changes, select Cancel.

-

Procedure to Correct ISIRs Using the DRN

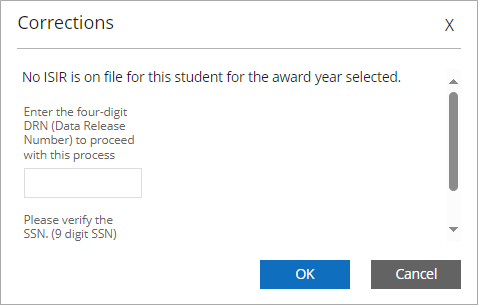

You can correct an ISIR that has not yet been received at the institution. If no ISIR is displayed after selecting an award year on the ISIRs Received form, you can still select the Corrections button. The following message will appear: “No ISIR on file. A DRN must be entered to proceed."

The 4-digit data release number (DRN) is assigned by the Department of Education to the student’s FAFSA on the SAR. If a student shares the DRN with your institution, you can use that number to access the FAFSA and make corrections, even if the student did not put the school code on the FAFSA. (If the school code had been on the FAFSA, the institution would have received the ISIR.)

-

Select the Student Profile.

-

Navigate to Financial Aid > ISIRs Received. The ISIRs Received form is displayed.

-

Select the Corrections button. If the student does not have an ISIR or the school code does not match, the system presents the Corrections pop-up.

-

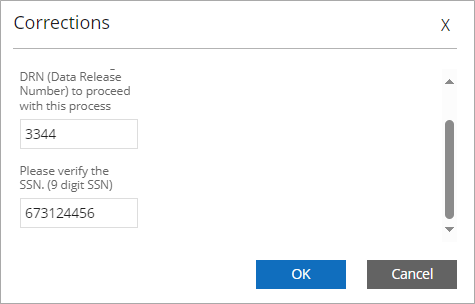

Specify the 4-digit DRN and scroll down to the SSN field.

-

If the SSN is available in the Student Profile, the SSN field is pre-populated. If the field is blank, specify the SSN and select OK.

-

The system displays the ISIR Corrections form. Note the SSN, DRN, and School ID fields at the top of the form.

-

Proceed with the ISIR corrections for 2024-25 and later as needed and save the form.

The New and Current value columns are empty. You can fill in new values. Select  for information about valid values. When you change a value, e.g., income, a message will indicate that no EFC/SAI is calculated, however, any ISIR corrections are saved and queued up for export to the FPS.

for information about valid values. When you change a value, e.g., income, a message will indicate that no EFC/SAI is calculated, however, any ISIR corrections are saved and queued up for export to the FPS.